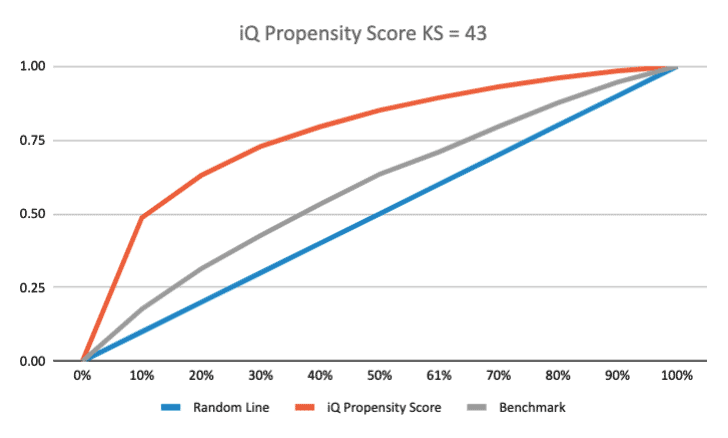

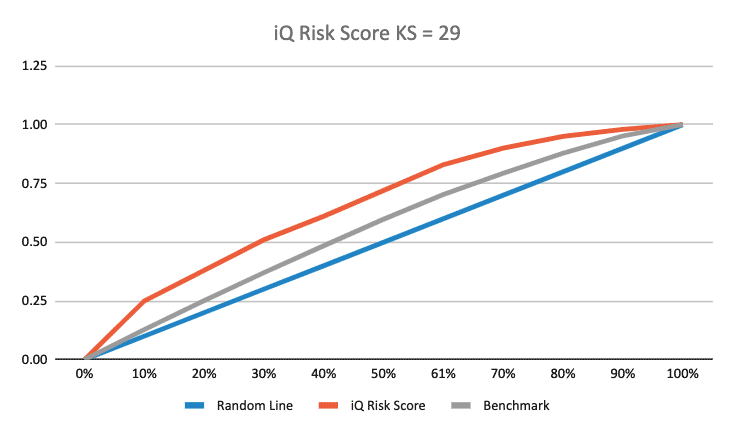

iQ Risk ScoreTM

Accurate and predictive credit scoring models maximize the risk-adjusted return of a financial institution. iQ Risk Score is a machine learning model designed to assess and minimize credit risk. It combines various traditional and alternative credit data along with proprietary data to provide a more complete consumer profile and insights that enables the lender to better predict consumer behavior.

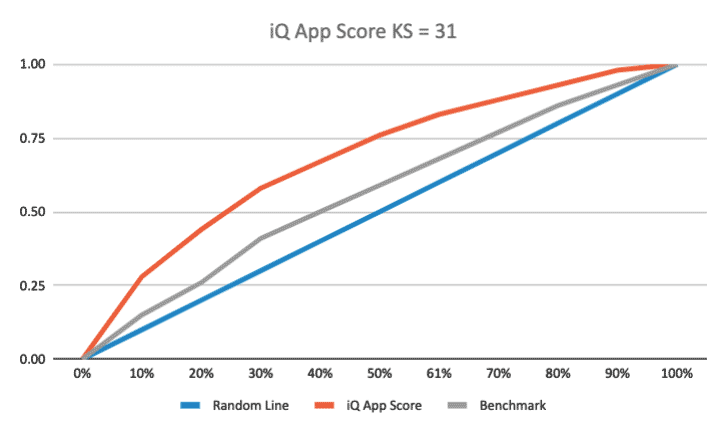

iQ App ScoreTM

iQ App Score is customized and most effective for evaluating applicants that respond to lenders Direct Mail offers.

iQ Fraud ScoreTM

iQ Fraud score allows organizations to combat both third-party and first-party fraud by providing near real-time insight into applicant's behavior on and off the web. iQ Fraud score is a multi-layered Al tool built upon information from both FCRA and non-FCRA data sources - for example, information like IP address tracing, device tracking, geo location, identity verification, email/phone risk assessment, and more. It can be used to identify fictitious or fraudulent applications and help minimize operational costs by effectively utilizing data to automatically authenticate the identity of a consumer.

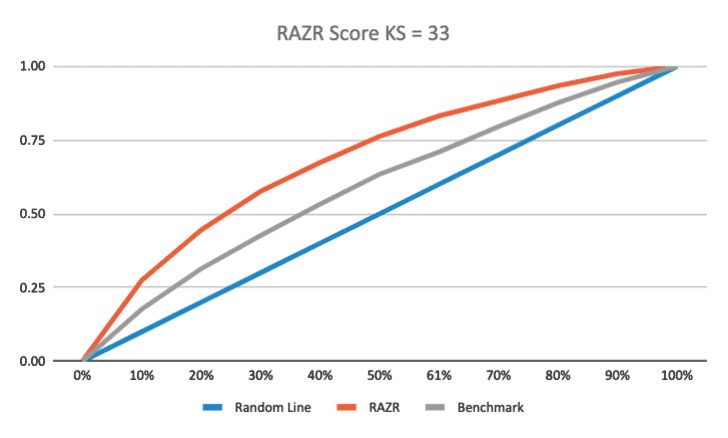

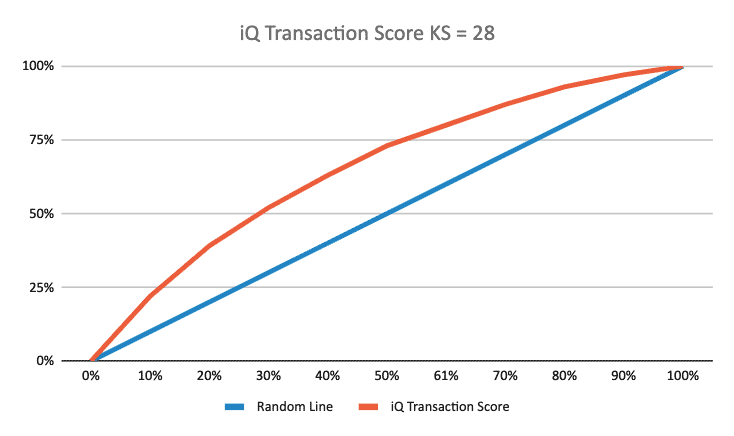

RAZRTM & iQ Transaction ScoreTM

RAZR & iQ Transaction Score are first-of-a-kind scores built on data that is not normally reported to CRA’s. It is powered by transactional data from consumer's bank accounts and other sources. It combines unique data representing the depth of transactional history, usage history, and cashflow patterns to generate a complete risk profile of the consumer that goes beyond a traditional credit risk score. These scores provide significant lift in segmenting risk and can be used to effectively implement first-party fraud strategies for high-risk consumer segments and upsell strategies for low-risk consumer segments. To obtain an iQ Transaction Score, lenders will need applicant's consent to obtain bank transaction data, while RAZR is built on proprietary data that does not require any consent or interaction from the applicant's side. Both RAZR and iQ Transaction Score are available for use on direct mail and non- direct mail programs.